tucson sales tax calculator

Usually the vendor collects the sales tax from the consumer as the consumer makes a. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Name A - Z Sponsored Links.

. The minimum combined 2022 sales tax rate for Tucson Arizona is. The current total local sales tax rate in Tucson AZ is 8700. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Sales Tax Calculator in Tucson AZ. Taxes-Consultants Representatives 1. You can find more tax rates.

Americas Tax Office of Arizona. Sales Tax Calculator in Tucson AZ. Tucson Sales Tax Rates for 2022.

Sales Tax Calculator in Tucson AZ. Name A - Z Sponsored Links. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

Method to calculate South Tucson sales tax in 2021. Method to calculate Old Tucson sales tax in 2021. The minimum is 56.

Method to calculate Tucson Estates sales tax in 2022. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Arizona sales tax rate is currently.

This includes the rates on the state county city and special levels. Arizona has a 56 statewide sales tax rate but also. How to Calculate Arizona Sales Tax on a Car.

The December 2020 total local sales tax rate was also 8700. Sales tax in Tucson Arizona is currently 86. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Name A - Z Sponsored Links. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The average cumulative sales tax rate in Tucson Arizona is 801.

South Tucson in Arizona has a tax rate of 10 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in South Tucson totaling 44. Multiply the vehicle price. Jackson Hewitt Tax Service.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. The County sales tax. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Method to calculate Tucson Meadows Mobile Home Park sales tax in 2022. 7253 E Pierce St Tucson AZ 85710 269000 MLS 22216258 Welcome to this 3 bedroom 2 bathroom home in sunny Tucson.

Tucson is located within Pima County ArizonaWithin. 3 beds 2 baths 1161 sq. This is the total of state county and city sales tax rates.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. As we all know there are different sales tax rates from state to city to your area and everything. Method to calculate Corona de Tucson sales tax in 2021.

How To Figure Sales Tax For A Car In Massachusetts Sapling

Full Trade In Tax Credit Is Back In 2022 Genesis Of Schaumburg

Missouri Car Sales Tax Calculator

Arizona S 30 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Tucson Arizona Sales Tax Calculator Us Icalculator

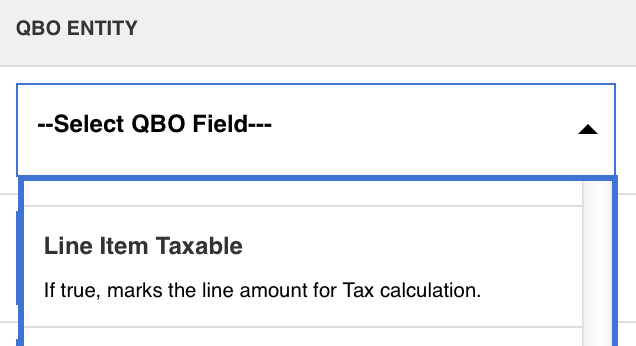

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Simple Car Finance Calculations Auto Loan Amp Lease Payments

2021 Mileage Rate Decrease Cents Per Mile Phoenix Tucson Az

Quickbooks Online New Features And Improvements March 2022 Firm Of The Future

2022 Cola Adjustments Year End Tax Planning Phoenix Tucson Az

How To Calculate Sales Tax For Your Online Store

Is Food Taxable In Arizona Taxjar

Property Taxes In Arizona Lexology

Lawmaker S Bill Would Eliminate Sales Tax On Gun Purchases In Arizona Local News Tucson Com